On September 24, the SEC’s Office of Investor Education and Advocacyissued an Investor Bulletin to educate investors about investing in unregistered securities offerings, or private placements, under Regulation D of the Securities Act.

The alert highlighted several “red flags” that investors of Regulation D offerings should be aware of. These red flags include claims of high returns with little or no risk, unregistered investment professionals, aggressive sales tactics, problems with sales documents, no net worth or income requirements, no one else seems to be involved, sham or virtual offices, not in good standing, unsolicited investment offers and suspicious or unverifiable biographies of managers or promoters.

The Investor Bulletin also defined the three SEC rules-Rules 504, 505 and 506-that issuers often rely on to sell securities in unregistered offerings and things that investors should consider before investing.

Rule 504

Rule 504 permits certain issuers to offer and sell up to $1 million of securities in any 12-month period. These securities may be sold to any number and type of investor, and the issuer is not subject to specific disclosure requirements. Generally, securities issued under Rule 504 will be restricted securities (as further explained below), unless the offering meets certain additional requirements. As a prospective investor, you should confirm with the issuer whether the securities being offered under this rule will be restricted.

Rule 505

Under Rule 505, issuers may offer and sell up to $5 million of their securities in any 12-month period. There are limits on the types of investors who may purchase the securities. The issuer may sell to an unlimited number of accredited investors, but to no more than 35 non-accredited investors. If the issuer sells its securities to non-accredited investors, the issuer must disclose certain information about itself, including its financial statements. If sales are made only to accredited investors, the issuer has discretion as to what to disclose to investors. Any information provided to accredited investors must be provided to non-accredited investors.

Rule 506

An unlimited amount of money may be raised in offerings relying on one of two possible Rule 506 exemptions. Similar to Rule 505, an issuer relying on Rule 506(b) may sell to an unlimited number of accredited investors, but to no more than 35 non-accredited investors. However, unlike Rule 505, the non-accredited investors in the offering must be financially sophisticated or, in other words, have sufficient knowledge and experience in financial and business matters to evaluate the investment. This sophistication requirement may be satisfied by having apurchaser representative for the investor who satisfies the criteria. An investor engaging a purchaser representative should pay particular attention to any conflicts of interest the representative may have.

As with a Rule 505 offering, if non-accredited investors are involved, the issuer must disclose certain information about itself, including its financial statements. If selling only to accredited investors, the issuer has discretion as to what to disclose to investors. Any information provided to accredited investors must be provided to non-accredited investors.

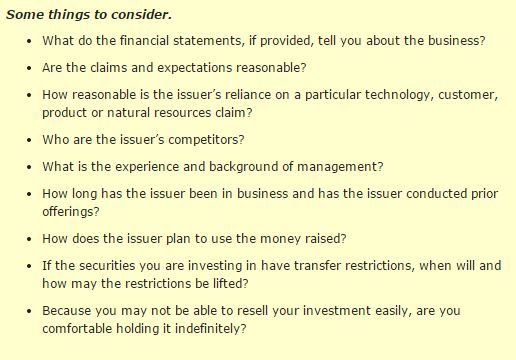

What should investors do before investing?