This information contained in this member analysis is for educational purposes and should in no way be construed as legal advice. Any opinions expressed belong solely to our guest contributor.

Carolyn Lee is the Founder of Carolyn Lee PLLC. Carolyn has represented regional centers, developers, funds, and investors for over a decade

by Carolyn Lee, Carolyn Lee, PLLC

(Read in PDF)

(Listen to the Engagement Recording)

On Friday, March 13, 2020, the USCIS Investor Program Office (IPO) held a stakeholder engagement about its announced change to EB-5 petition processing. First announced on January 29, 2020, the new approach would change I-526 processing from a first in first out or “FIFO” approach to one based on visa availability. The new process starts March 31, 2020 and will apply to all pending I-526 petitions not yet assigned for adjudication. Impacts at the visa issuance level are not expected to be immediate. If this processing change results in relatively faster I-526 petition processing for petitioners from countries with EB-5 visa availability, these investors would be expected to be issued visas earlier than under the FIFO process.

What does this mean? For context, EB-5 petitions are currently processed roughly based on order of receipt at USCIS. I say “roughly” because USCIS seems to be trying to group petitions by new commercial enterprises, which makes sense to avoid duplicative adjudications. Under the new process, instead of queuing EB-5 petition processing by date of receipt, USCIS would queue EB-5 petition processing by visa availability, prioritizing petitions from countries with visa availability.

To illustrate, let’s take a Form I-526 filed October 1, 2018 by a German investor. Under FIFO, this case went behind the 14,000 or so petitions pending at IPO at the end of FY 2018. Under the new process, however, if this case is not yet assigned, it would be “prioritized” ahead of pending petitions connected to petitioners with earlier filing dates from visa-backlogged countries.

Although USCIS has avoided discussing the actual speed with which these prioritized petitions would be processed, the petitions associated with visa available countries would certainly be processed ahead of petitions associated with visa backlogged countries.

Why is USCIS doing this? USCIS says it’s doing this because the visa availability approach “better aligns the EB-5 program with congressional intent” and “increases fairness, allowing qualified EB-5 petitioners from traditionally underrepresented countries to have their petitions approved in a more timely fashion to receive consideration for a visa.”

On its face, there is plain sense in this. Let’s suppose USCIS approves a Form I-526 for a Chinese investor today with a priority date of October 1, 2018 just like our German investor. Because this investor’s priority date is not yet reached, she will be unable to be issued an EB-5 visa. If USCIS had instead spent its adjudicative resources on the German investor who filed on the same day, because he has an immediately available visa, he would advance to visa issuance and use a visa number allocated to Germany.

Scratching the surface, though – as you know I would – we see that there are some downsides. The most striking is for backlogged investors who need an approved I-526 petition to preserve that petition’s priority date. If an investor is facing the possibility of a material change to her business plan or regional center termination, the delay of her approval under the new processing system could be prejudicial indeed.

The new process also distracts from the real question: why does USCIS need so much help managing its inventory, when it adjudicated three times as many cases with 100 fewer personnel in a fraction of the processing time just two years ago? Hold that thought.

What did we learn at the March 13 engagement from IPO? We learned quite a bit, thanks largely to the unannounced participation of Charlie Oppenheim, Chief, Immigrant Visa Control & Reporting Division of the State Department. Ms. Sarah Kendall, Chief, IPO, spoke for USCIS, starting with the new “inventory management” processing change, but also covering several other topics.

Let’s start with what we learned from Ms. Kendall:

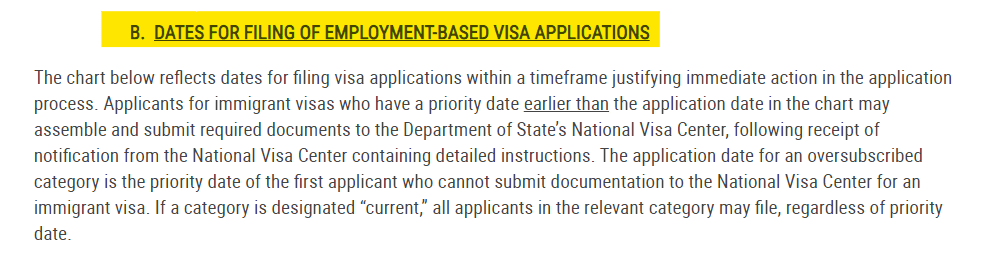

(1) USCIS will use the Visa Bulletin, Chart B, Dates for Filing to determine which countries’ investors will be prioritized. Below is a snapshot from the April 2020 Visa Bulletin of Chart B:

(2) Starting March 31, 2020, the new inventory management process will be applied to all pending and unassigned I-526 petitions. Petitions that have already been assigned will proceed to adjudication.

(3) Investors with visa availability based on visa chargeability to a country other than investor’s country of birth (for example, by virtue of cross-chargeability to spouse), will be able to notify USCIS by e-mail.

(4) There is no means to “opt out” of the new process.

(5) There are 240 dedicated personnel working at the IPO.

(6) There will be no change to the expedite process. If there has been an approval for expedited treatment, the petition will be immediately distributed for review.

What didn’t we learn from IPO? We didn’t learn why USCIS can’t manage its current inventory. USCIS receipted about 3 times as many I-526s in FY 2016 and FY 2017 than it did in FY 2019. Yet in FY 2017 and FY 2018, USCIS adjudicated about three times as many I-526s as IPO completed in FY 2019. All the while, IPO is taking longer than ever by years, not months, to process I-526 petitions; USCIS reports it is currently taking 33 to 50 months to process I-526s.

This makes even less sense since Ms. Kendall reported there are 240 dedicated IPO staff. IN 2016, there were only 113 and IPO was raising this number to just 170 in FY 2017. IPO’s inability to manage its current significantly diminished case load presumably prompted, in part, this inventory management change. Although the author asked for visibility into this operational problem, IPO declined providing an answer.

What did we learn from the Visa Control Office? Mr. Oppenheim was a surprise guest at the March 13 engagement. He shed some insights not immediately apparent on the face of the processing change. What we learned from Mr. Oppenheim:

(1) EB-5 visa numbers and their availability under the per country cap limits remain the same as before the processing change.

(2) Use of any unused visa numbers also remains unchanged. Any unused visas will be made available to any country/countries already at the per country cap limit.

(3) The impact of the policy change won’t be felt for about 12-18 months.

(4) This change “may increase visa availability for countries for which processing may have been impacted under the previous first in first out methodology.”

(5) The rate of USCIS processing on pending petitions will determine “when and if” there will be any negative impact on the availability of otherwise unused visas which would be made available to countries at their per country limit.

(6) Applicants who previously benefited from numbers unused by other countries (primarily Chinese investors) must, at some point, wait until visa numbers are available for their country.

(7) Only one country may see decrease in EB-5 visa availability before FY 2022 – China.

Some of that is not readily understood by mere mortals. It took me some parsing as well. Here’s my gloss:

(1) The USCIS processing change doesn’t change statutory visa allocation. The visa numbers themselves are set by statute (approximately 10,000 for EB-5), and so are the per country limits (approximately 700 per country for EB-5). Similarly, unused per country allocations “fall across” to countries who have reached their per country limits. None of this architecture in the visa allocation framework is affected by the USCIS inventory management change.

(2) State Department apparently does not anticipate meaningful levels of USCIS petition approvals from visa available countries for 12-18 months.

(3) There will be an even longer wait for Chinese investors in the backlog when the impacts are felt, because there will be fewer visas to “fall across” to countries at the per country limit like China.

Are we in EB-5 longing for the China market’s return to EB-5? To bring it back, we’re going to need statutory reform now more than ever. In the meantime, the USCIS processing change is a salve, but it will depend on how quickly USCIS in fact processes these “prioritized” cases.

Ms. Kendall referred more than once to February numbers showing improved IPO performance to be released at some point in the future. We’ll need to see those. And it looks like it might be about a year until we see actual approvals on prioritized cases. Visa allocations on those approved cases would be expected to occur in FY 2022 (October 1, 2021 to September 30, 2022).