Double Jeopardy: The Risks of Early Bird Repayment

If at First you Don’t Get in trouble, Now There’s a Second Chance to Fumble (Vol. 3, Issue 2-July 2015)

By Michael G. Homier and Parisa Karaahmet

Today’s new reality of retrogression of immigrant visa numbers for Chinese Nationals in the EB-5 category has sparked debate about certain aspects of the EB-5 program previously thought to be settled, which, some now argue, require modification and modernization in order to come to terms with the new EB-5 world order. The issue of repayment has always been at the forefront of investor considerations, along with job creation. Retrogression raises new concerns for Chinese investors, namely, what happens to an EB-5 investment when it is ready to be re-paid, but an investor’s immigration process has not yet been completed?

Customarily, investors have sought repayment of EB-5 capital usually after five years of making their original investment. Given the securities imperative to disclose all material facts and risks of every EB-5 investment, well-crafted offering documents commit the EB-5 “new commercial enterprise” (“NCE”) to a repayment of funds on this time frame. This was intended to account for the amount of time the capital and corresponding loan or equity investment are deployed into a job-creating entity (“JCE”)’s project, and leaving generally sufficient time for an investor’s EB-5 immigration process to be completed,(i.e. the final approval of their Form I-829 petition and removal of conditions on their permanent residence). EB-5 regulations require that an investor’s capital remain “sustained” and “at risk” throughout the pendency of their immigration process. The 2013 EB-5 Policy Memorandum reiterates that at risk capital must have a “risk of loss and a chance for gain”. The memo emphasizes that the capital be “sustained”, stating that at the Form I-829 stage, USCIS will require evidence that investor funds were sustained in the NCE.

Prior to retrogression, it was expected that ordinarily the five year period typically established in EB-5 projects would more than suffice to enable the investor to get through the I-829 process while his or her investment remained invested “at risk” in the EB-5-qualifying project. At the same time, five years was believed to be a reasonable time for the JCE that received the EB-5 funds to reach a level of stabilization or maturity sufficient to enable it to satisfy an obligation to repay to the NCE the aggregate EB-5 funds that had been invested in a more-or-less lump-sum payment. Perhaps an extension of an additional year would be negotiated, in the unusual case that the new JCE business might need one more year of operation to comfortably accomplish the repayment. Yet it was broadly believed that in almost all cases, by the time the business reached the repayment deadline, all investors would have long since completed the 829 process and the satisfaction of all conditions on permanent residency.

The “at risk” and “capital sustained” requirements have taken on new urgency since the retrogression of immigrant visa numbers for Chinese Nationals, first in August 2014 for the 2013-14 federal fiscal year, and again in May 2015 for the current year. Now, visa backlogs are expected to result in significant delays in the approval of Chinese investors’ I-829 petitions, as compared both to past experience, and to non-Chinese investors. As a result, all actors within the new world of the EB-5 Program must deal with the issue of early repayment: it might take “retrogressed” Chinese investors six, seven, or even eight years to reach removal of all conditions on permanent residence. So a standard commitment to repayment of all investors at the end of five years could result in their funds, upon repayment, being considered by U.S. Citizenship and Immigration Services (“USCIS”) as no longer sustained in the qualifying investment and hence no longer at risk-which in turn could lead to a denial of the I-829.

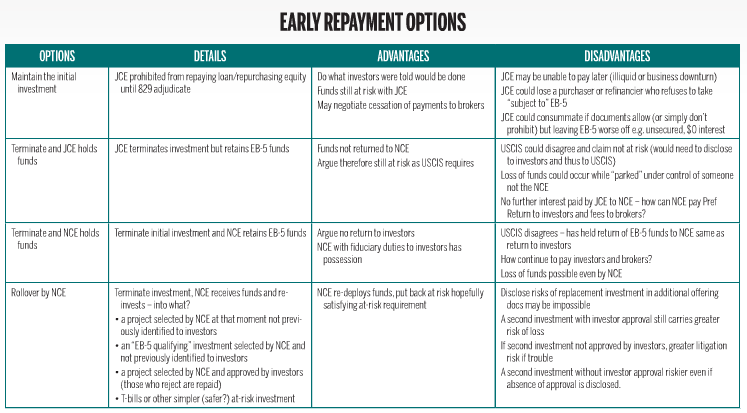

On the face of it, the dilemma seems bad enough: as a condition on investing, EB-5 investors require a repayment commitment at some future date, which under the securities laws must be disclosed in the written offering documents, but under the immigration laws, absent guidance from USCIS (which to its credit has acknowledged the issue and promised a response… at some time), Chinese investors (and therefore their EB-5 projects) must fear a repayment too early. But the dilemma is even more complicated: if I-829 petitions are still pending at the time the JCE’s repayment commitment date is reached, some mechanism needs to be adopted (and disclosed) to enable those investors to keep their capital “sustained” and “at-risk” in order to comply with the EB-5 Program requirements-but what mechanism? May these funds be simply retained by the JCE and set aside, perhaps beyond the time when the funds are actually needed/used for job creation purposes? May the funds be returned by the JCE to the NCE and retained there, when USCIS has previously taken the position that funds returned to the NCE may not fulfill the at risk requirement? May the funds permissibly be reinvested in another alternative investment (and need/must it be an EB-5-qualifying project), thereby incurring new risks, and if so, by the JCE or by the NCE? The following chart graphically depicts some of the more obvious options, and only some of their respective advantages and disadvantages:

Both immigration and securities attorneys alike are re-evaluating project due diligence and regional center offering documents in considering early repayment implications. From a securities perspective, the imperative mentioned above that investors be given full disclosure of all material parameters of the proposed EB-5 investment compels the NCE to decide which of the options sketched out in the chart are to be committed to by the NCE.

The decision then needs to be explained in writing in the offering documents, including the risks (“disadvantages,” in the chart) attendant to each option included. The more options, the greater the flexibility, but the more risks need to be included; by contrast, the fewer the options, the lesser disclosure is required, but the NCE bears a greater risk that the option selected will not best fit the circumstances that govern some 5-8 years in the future.

In light of visa retrogression, a Chinese investor will need to reflect on how much control he or she will have over the decision regarding what will happen to their investment if their I-829 has not yet been approved when the NCE’s deployment of EB-5 funds to the JCE is ripe for repayment. These investors are potentially facing a second investment evaluation process, during the elongated pendency of their I-829 applications, combined with the risks of the second investment’s outcome. This could require continued engagement of counsel for additional immigration and securities/business law due diligence advice regarding the re-investment of capital from an EB-5 compliance perspective. If alternative investment vehicles are included, investors may no longer receive the same return on their investment as interest rates on the EB-5 funds may be re-negotiated, or lost entirely if the “roll-over” investment fares poorly. It can be argued that an Investor’s bargaining power or control will be significantly weaker due to the fact that their ultimate immigration benefit, removing the condition placed on their permanent residence, hangs in the balance. While investors already begin to see the consequences of retrogression on their EB-5 investment decisions, EB-5 issuers and developers similarly need to adjust policies to accommodate the variety of circumstances and issues involved in tackling the chance of early repayment.

It remains to be seen what type of institutional impact visa retrogression and early repayment will have on EB-5 issuers and developers, and if the smaller regional centers or projects may be more negatively impacted by a lack of other readily available investment projects or alternatives for investors who believe they need to keep their capital at risk and sustained. This begs the question of how smaller NCE issuers can attract investors on an even playing field, and if only the larger regional centers and issuers can survive in this new environment. In any event, it is becoming increasingly clear that in the absence of USCIS guidance in this area, Regional Centers, issuers, counsel, and investors alike will need to be nimble in formulating potential solutions to reduce the impact of double jeopardy on investors who have already proven their green card worth. While the effects of visa retrogression have not yet reached all levels of the EB-5 process, wise parties have already started to prepare for the potential outcomes and consequences.

RCBJ Retrospective articles are reprinted from IIUSA’s Regional Center Business Journal trade magazine. Opinions expressed within these articles do not necessarily represent the views of IIUSA and are provided for educational purposes.