Surprising Revelations in 2023 EB-5 Data

By Laura Kelly | Vice President, Marketing; JTC

At a recent webinar from IIUSA and JTC, statistics from the past year showed how much activity has increased since the RIA and where opportunities may lie.

watch the webinar

How has EB-5 been doing lately? It’s not such an easy question to answer, especially when one of the most recognizable features of USCIS is how difficult it can be to get information out of the agency. In order to understand the state of EB-5 since the passage of the EB-5 Reform and Integrity Act of 2022 (RIA) and where the program is today, industry stakeholders have to pool our resources.

That was the motivation behind IIUSA’s February 14 webinar, “EB-5 in 2024: What Do We Know?” Sponsored by JTC, the event featured exclusive data and insights from experts hailing from different corners of the EB-5 world. Together, they analyzed this new information in an attempt to answer some of the biggest questions facing the industry.

How did EB-5 fare in 2023?

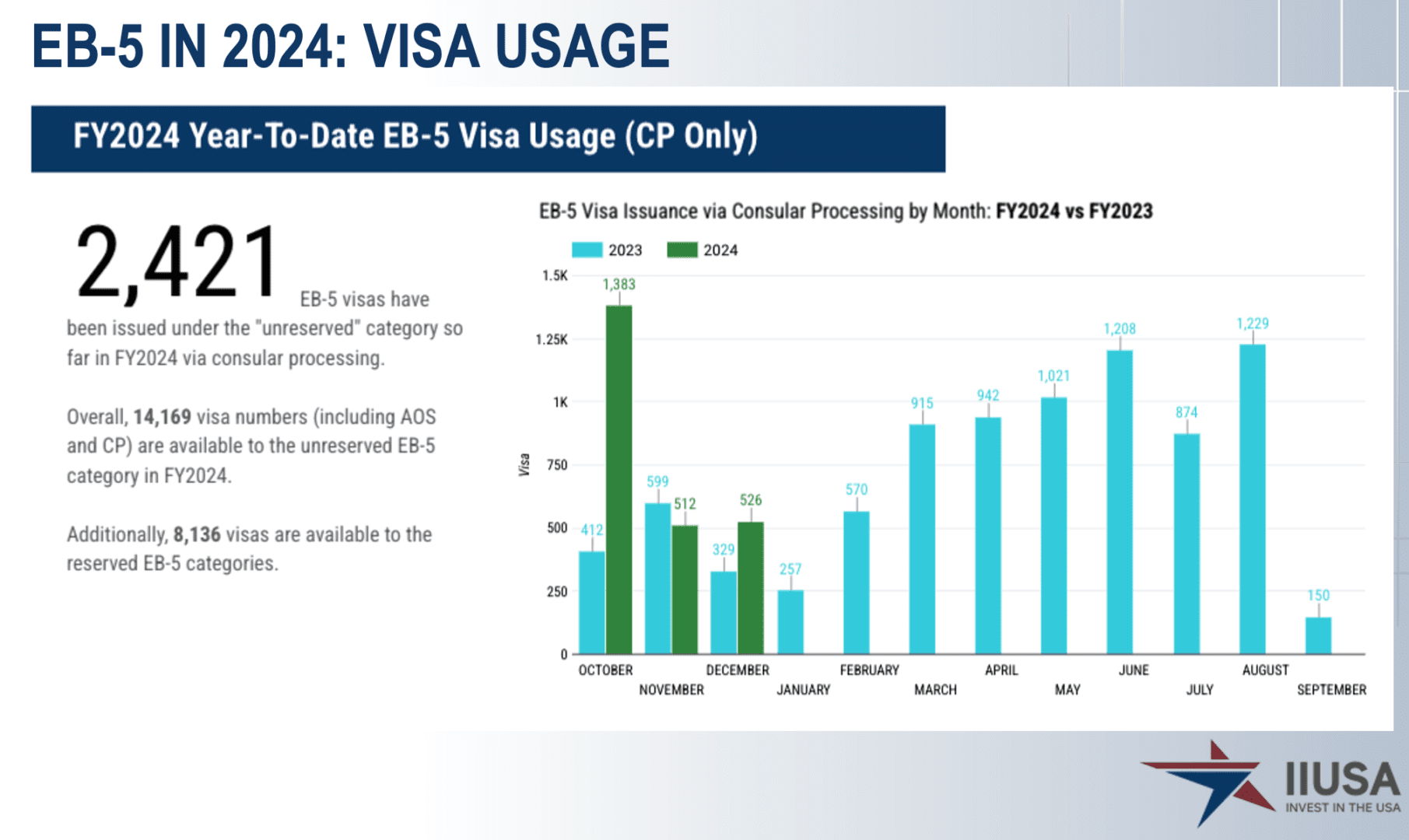

At the webinar, IIUSA Director of Policy Research & Data Analytics Lee Y. Li shared numbers from 2023, the first full calendar year under the RIA, and how they compared to previous years.

“I think these statistics are very encouraging,” said Li, who informed the panel that I-526/526E case filings increased 215% year over year while steadily increasing each quarter of 2023. In addition, case adjudications went up by 170% in FY2023.

“That is very, very welcome news,” said Joey Barnett, Partner at WR Immigration. “That’s something that we have been waiting to see.”

Nearly $2.1 billion in EB-5 investment was raised in FY2023, with the post-RIA total estimated at $2.3 billion.

“2023 was a good year,” said Li, who noted that the EB-5 capital raised was enough money “to buy everyone in the U.S. a dozen red roses.”

Can we expect this growth to continue? Will activity and interest in EB-5 increase in 2024?

According to moderator Jill Jones, JTC General Counsel, while we’ve made progress, EB-5 hasn’t fully recovered from the Regional Center program lapse.

“If I look at this chart, and it’s going from 2008 to 2023,” said Jones, “we’re nowhere near pre-RIA numbers, are we?”

Nonetheless, the panel was optimistic. “The upward trend is definitely there,” said Eren Cicekdagi, Managing Director of Operations at Golden Gate Global.

“Regional Centers now are back to business, and EB-5 is definitely back,” added Barnett. “2024 is going to be a great year.”

Where has investment been coming from since the renewal?

Jones also shared data based on JTC’s work as an EB-5 administrator, presenting a cross-section of what’s happening in the industry to identify trends in the EB-5 investor market.

“One of the most common questions we get is ‘what countries are the immigrants coming from?’” said Jones.

It was expected that the RIA’s reserved visa categories and priority processing would bring renewed interest from retrogressed countries, specifically China and India. Based on the data, that appears to be true.

“Between China and Taiwan, we’re at over 58% of all the investors coming in,” said Jones. “We’re seeing a resurgence here.”

Cicekdagi explained that because of its previously robust EB-5 industry, China was well-placed to get things back up and running after the renewal.

“The set-asides really created this kind of legitimate hype in the Chinese market and Taiwanese market to put these agents back to work,” said Cicekdagi. “Today, there’s a lot of hype and excitement from these markets, but this doesn’t really reduce the fact that other markets are also interested.”

As far as where other interest has been coming from, Cicekdagi pointed to concurrent filing of Adjustment of Status as a driver of interest from holders of H-1B or student visas.

“In San Francisco, there are a lot of H-1Bs, people that come from India,” he said, though he cautioned that this level of interest could ultimately lead to retrogression yet again.

“It’s great that they put that in the legislation,” said Barnett, who stressed that concurrent filing allows immigrant parents to make better decisions for their families. “It’s all about the children and making sure their children have a clear future.”

While H-1B visa holders are an exciting category of new potential investors, they also have different needs and financial situations than some other EB-5 investors, bringing up another big point of discussion: increased filing fees.

Will increased filing fees affect EB-5 interest?

USCIS recently announced new filing fees for both EB-5 investors and Regional Centers, representing increases of as much as 204% for I-526 applications and 168% for I-956 applications. Could these fees discourage investors from pursuing EB-5?

“It’s definitely another upfront cost,” said Barnett. “Not everybody who does EB-5 has tens of thousands of dollars sitting around. This is their life savings, and they’re scraping through as much as they can or taking out additional debt to fund EB-5.”

“I don’t think this is really going to slow down the market,” said Cicekdagi. But will it create a surge in investment to get applications in before April 1st, when the changes take effect?

“We are seeing a little bit of a surge, and I expect there to be a lot of cases filed in the next six weeks,” said Barnett, who added that for many EB-5 investors, fees that amount to 1% of the total being invested are not enough to cause them to rush things. “It’s really up to the individual.”

Jones asked the panel about partial payments, and whether this option is realistic for those who want to get in before the deadline.

“It’s permissible and it’s definitely something a lot of people are looking at, in particular because of April 1st,” said Barnett, stressing that “it needs to be done the right way” and that investors need to understand the ramifications.

“If you don’t put your full money in right away, then your sustainment period doesn’t really start until that full money has been made available to the JCE for use,” said Barnett.

The new sustainment period could have an effect on the types of projects investors look for. Will short-term projects become the norm? Are rural projects going to dominate the market? What do investors care most about right now? That data had some answers.

What are EB-5 investors looking for in a post-RIA world?

One of the surprises in the data was that more than 380 Regional Centers have applied for designation since the RIA, with 231 new projects already launched.

“There’s a lot of options for investors to look at,” said Li.

“The market’s going to be overcrowded really soon,” said Cicekdagi, who expects the demand for rural to continue. “A good rural project appeals to everyone,” he said. “It doesn’t have to be a retrogressed country.”

There was also a wide-ranging discussion of the new sustainment period and how investor demand for shorter deals may change how projects are structured. While this may occur in the future, Jones shared data that indicated larger projects are still dominating the market.

“Investors are still looking for projects that have a reputation, that have a track record,” she said. Looking at the projects that have been funded post-RIA, she noted, “they’re very large projects, far larger than I would have expected.” This makes sense from the perspective of investors who care more about the success of their visa applications than anything else.

“I want to be sure that I get my green card, so who’s done this before?” said Jones, noting that JTC’s focus on best practices comes from both concern for program integrity and investor immigration success. In short, “how should people be treating other people’s money?” With a lot of projects to choose from, investors can be picky about who they choose to work with.

More topics were covered at the webinar, including what steps should be taken to ensure the future health of the program. There was also more data shared that won’t be found anywhere else.

To see more data and hear insights from the panelists, watch the full webinar recording from IIUSA.

IIUSA members are able to access the recording free of charge. Visit the “discount page” in the IIUSA Member Portal to obtain the coupon code.