Dear EB-5 Regional Center industry,

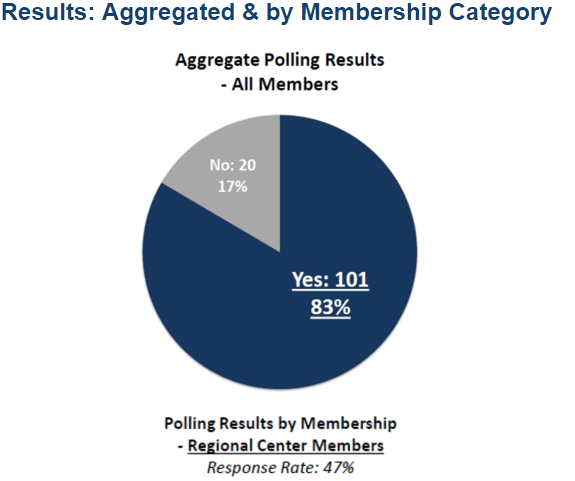

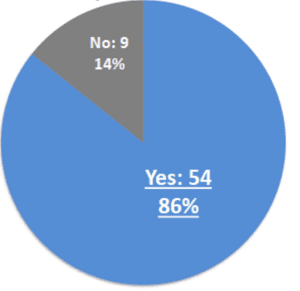

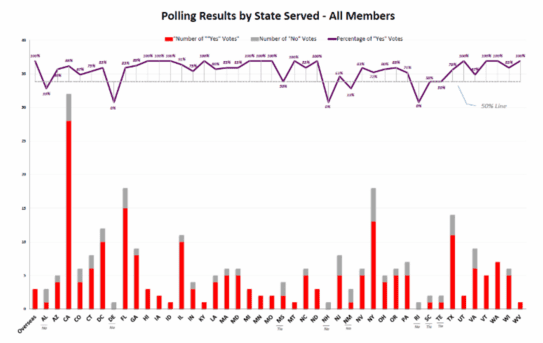

Yesterday, IIUSA proudly delivered its EB-5 legislative compromise proposal (the “Proposal”) to Congress. The Proposal was supported by unanimous vote of the IIUSA Board of Directors and Public Policy Committee, with 83% support from the IIUSA Membership in a poll taken last week. It addresses the four major issues holding up the reauthorization and reform of the EB-5 Regional Center Program (the “Program”) before its current “sunset date” of December 11, 2015. These four issues are:

- Targeted Employment Areas (TEAs);

- minimum investment amount;

- job creation methodologies; and,

- effective dates.

We are cautiously optimistic that negotiators will find the Proposal useful charting a path forward to a long term reauthorization deal.

Click on the links below to download IIUSA’s letters to the House of Representatives and Senate:

Find your representation in the House of Representatives and Senate so you too can deliver the above letters to Congress!

IIUSA is a diverse organization of over 290 Regional Center and 220 associate members. Our members represent big and small projects, urban and rural economic development, and industry sectors ranging from real estate to manufacturing to energy to infrastructure to economic development. The compromise proposal was carefully crafted in a way that has been accepted by the Board of Directors, the Public Policy Committee, and now a large majority of the membership which we believe will be a catalytic force in reauthorization negotiations.

The EB-5 Regional Center Program is due to “sunset” on December 11, 2015 – a mere 39 days from today. It is imperative that Congress quickly come to an agreement on long term reauthorization and reform of the EB-5 Regional Center Program that provides ample time for discussion on the other issues included in current draft of legislation. The Proposal represents significant concessions from the EB-5 Regional Center industry that we are willing to accept in order to protect one of the most successful economic programs in modern history, with its best days ahead. #EB5isWorking

I look forward to reporting back on the feedback we receive from Capitol Hill and on how we can work together to ensure the Program is reauthorized for the long term before December 11. Thank you for your support!

Sincerely yours in service,

Peter D. Joseph

Executive Director, IIUSA

Recommendation for Compromise on EB-5 Reauthorization & Reform Legislation

The Proposal is the result of careful and full consideration of current state of national politics, EB-5 and global immigrant investor industry data, recommendations from the Public Policy Committee, and the various legislative proposals on EB-5 from current and past Congresses (S. 1501, S. 2115, S. 2122, H.R. 616, and H.R. 3370 from the current 114th Congress; S. 744, amendment #1455 to S. 744, H.R. 2131, and H.R. 4178 from the previous 113th Congress). The intent of the Proposal is to balance the diverse interests within IIUSA membership to ensure the Program is reauthorized for the long term with reasonable reforms that succeed in enhancing program integrity and effectiveness.

- Job creation methodologies: No geographic limitation on indirect job creation or limit on non-EB-5 capital contributions to project economic impact, or other changes to how job creation in currently measured.

- The ability to count indirect jobs in a manner consistent with regional economic development goals and the purpose of the EB-5 Regional Center Program is vitally important to maintain the utility of the Program. Maintaining the current policy on job creation will ensure that the true economic impact of the EB-5 Program is taken into account for investors seeking to qualify for their immigration benefits.

- Minimum investment amount: New minimum investment of $800,000 in TEAs and $1,000,000 in non-TEAs.

- Narrowing the delta between TEA and non-TEA investments should make it more feasible for projects in either category to raise capital, while the middle ground on TEAs above would provide sufficient opportunity for urban areas to qualify as TEAs, as happens today in much of California. The $200,000 difference is less than half the difference currently proposed in S. 1501 ($800,000 and $1,200,000) and strikes a better overall balance in average amount than H.R. 3370, which proposed $1,000,000 and $2,000,000 as the TEA and non-TEA amounts, respectively. To be successful, the EB-5 program must be competitive with global immigrant investor programs in price and risk. A balanced two-tier system would help keep the Program competitive globally while giving both urban and rural areas the ability to compete for EB-5 investments.

- Targeted Employment Areas (TEAs): High unemployment TEAs must be a geographic area or political subdivision consisting of no more than 12 contiguous census tracts or smaller subdivisions. Zero population subdivisions may not be used to establish contiguous connection between census tracts not otherwise connected.

- This proposal is modeled on the state of California’s current approach and strikes a balance between the restrictive approach of S. 1501 and more expansive approach found in S. 2115 which represent the two ends of the spectrum in this debate.

- Effective dates: Program reforms do not apply to any investors who filed an I-526 petition before the date of enactment.

- Ensuring that all I-526 petitions are adjudicated using the rules under which they were filed, including those filed after 9/30 and the date of enactment for new legislation, is imperative to maintain investor confidence in due process, the American legal system-and as a result — the EB-5 Program. Any retroactive application of any new rules on investors who have filed I-526 petitions under the existing rules would be reminiscent of 1998 when new rules from precedent setting Administrative Appeals Offices (AAO) decisions were applied retroactively. The resulting situation effectively froze the Program for more than four years as litigation proceeded and investor confidence disintegrated. The most important difference between 1998 and 2015 is the number of investors who would be affected, with well over 13,000 petitions currently pending at USCIS.