04.24.24

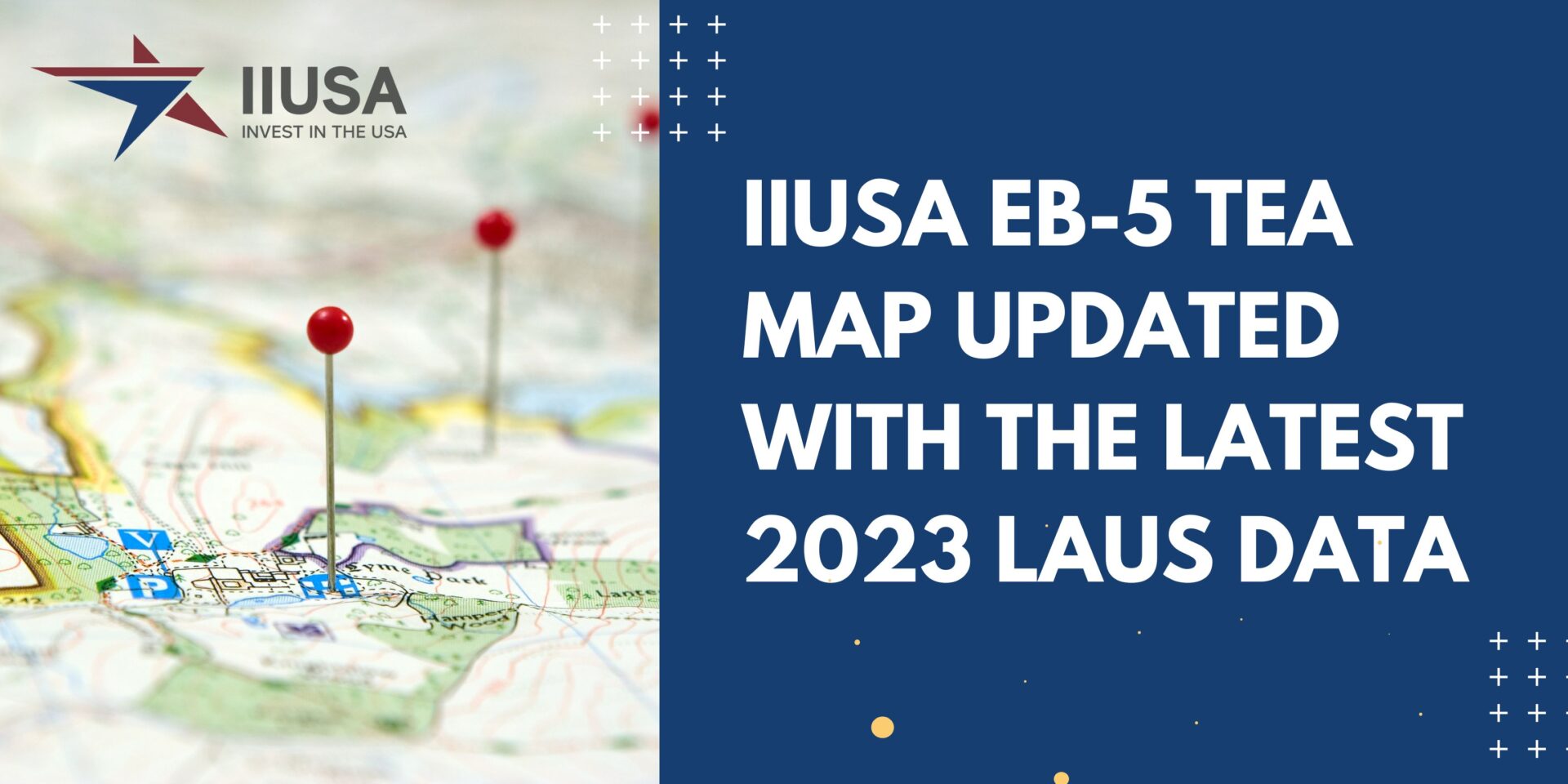

Last week, the U.S. Bureau of Labor Statistics (BLS) released the latest 2023 annual data for Local Area ...

04.22.24

IIUSA PAC Continues to Grow, But It Needs Your Support

In 2023, Invest in the USA (IIUSA) established a ...

04.17.24

Are you a professional in the EB-5 visa space looking to deepen your industry knowledge and build valuable ...

04.15.24

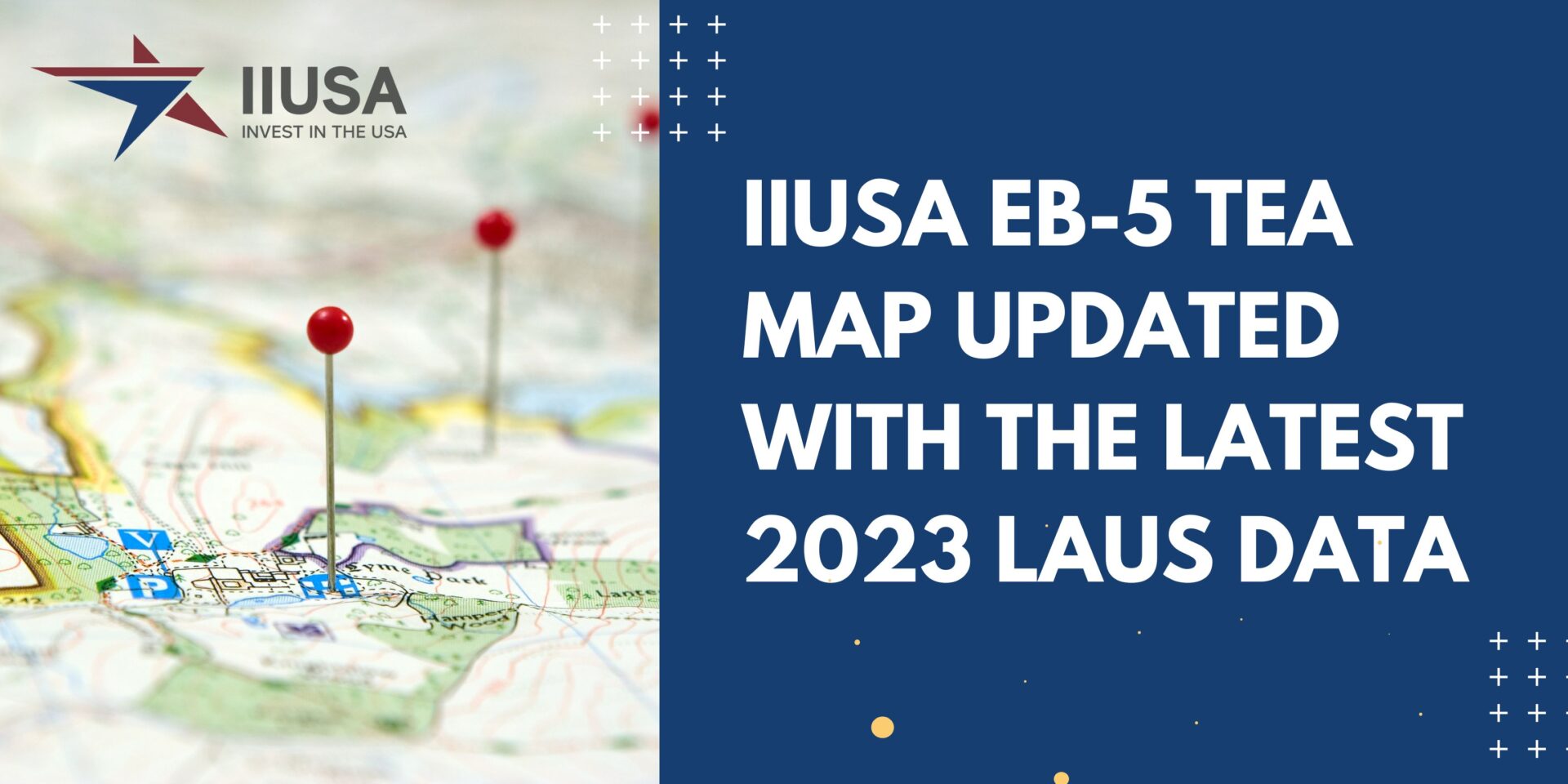

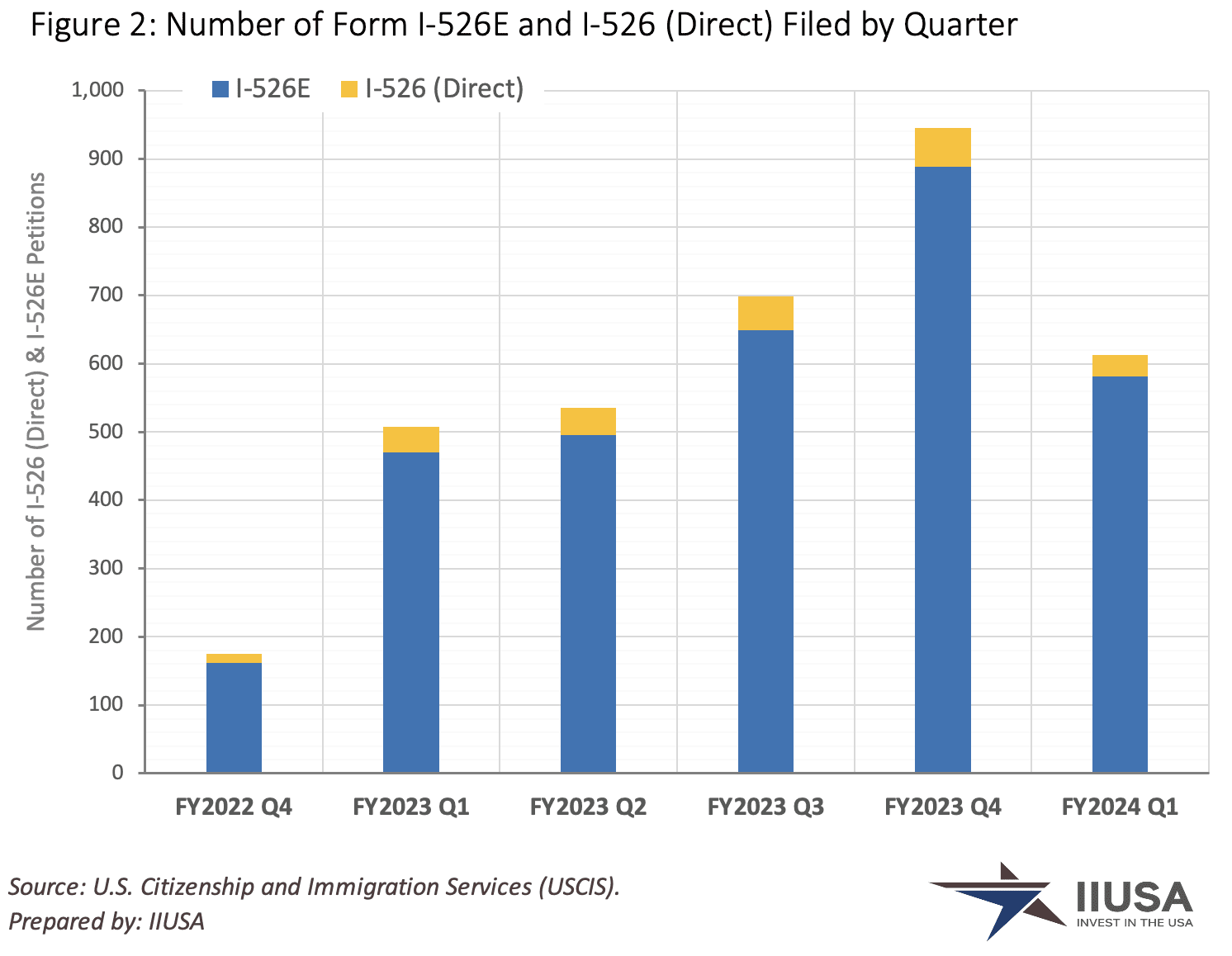

Last week, USCIS published the quarterly statistics for Q1 FY2024 (October 1 – December 31, 2023). The latest data ...

04.12.24

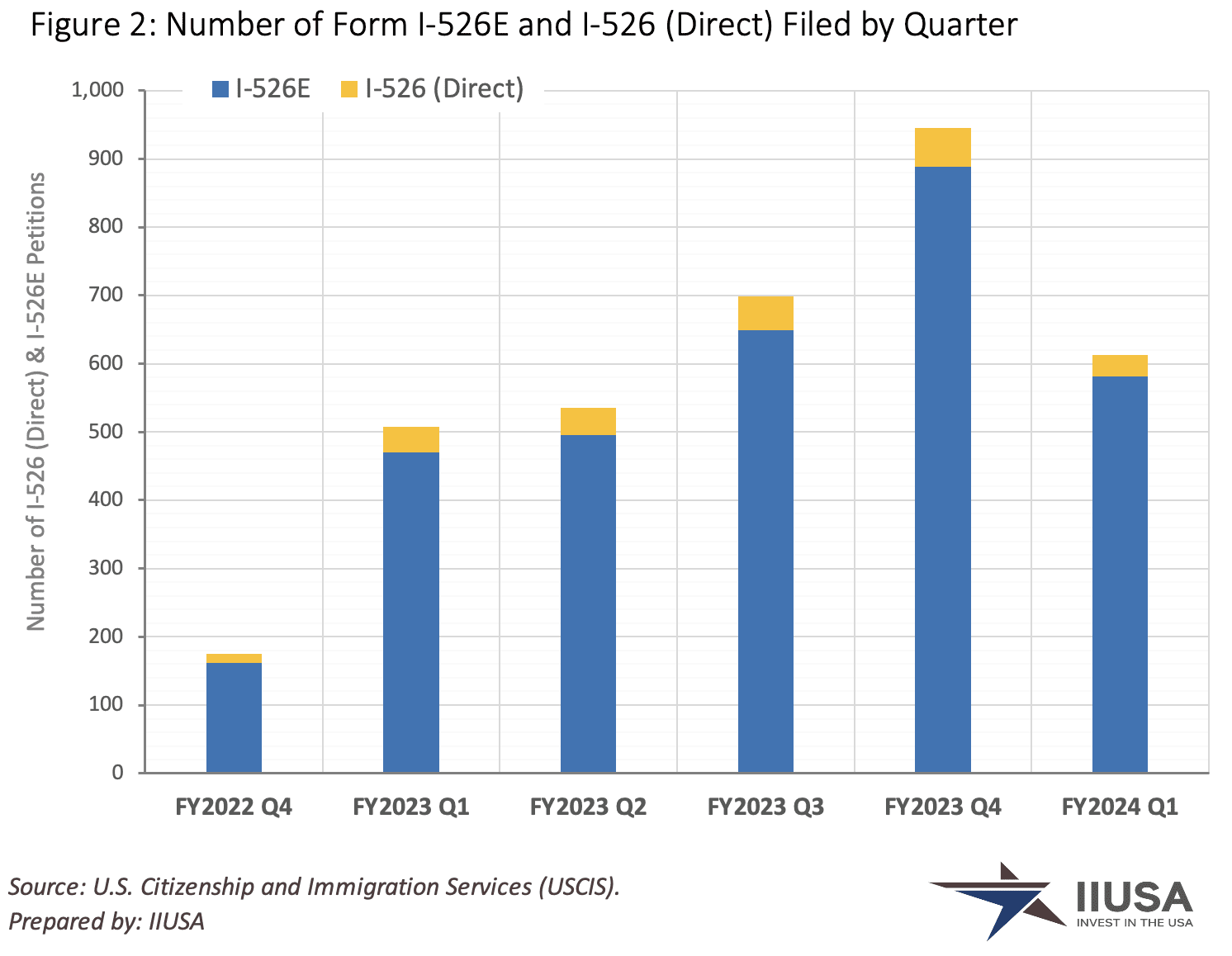

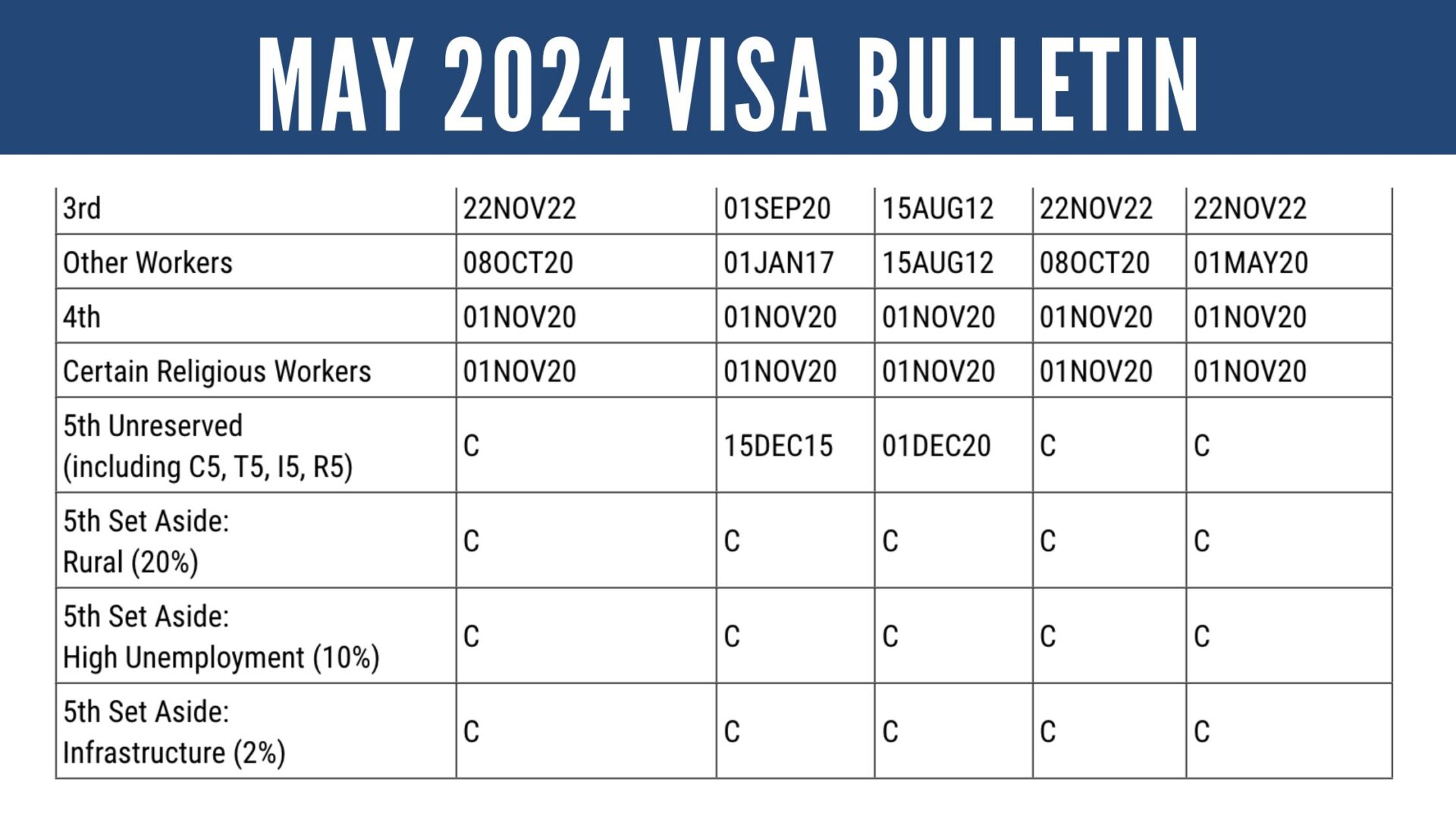

Earlier this week, the U.S. Department of State released the monthly Visa Bulletin for May 2024 (see here) showing ...

04.11.24

WATCH HERE

On a recent webinar discussion IIUSA Executive Director, Aaron Grau, shared his invaluable insights ...

04.10.24

Meet the Speakers of the 2024 IIUSA EB-5 Industry Forum

IIUSA is proud to present the speaker line-up for its ...

04.09.24

Under the Reform and Integrity Act of 2022 (RIA), U.S. Citizenship and Immigration Services is now required to ...

04.09.24

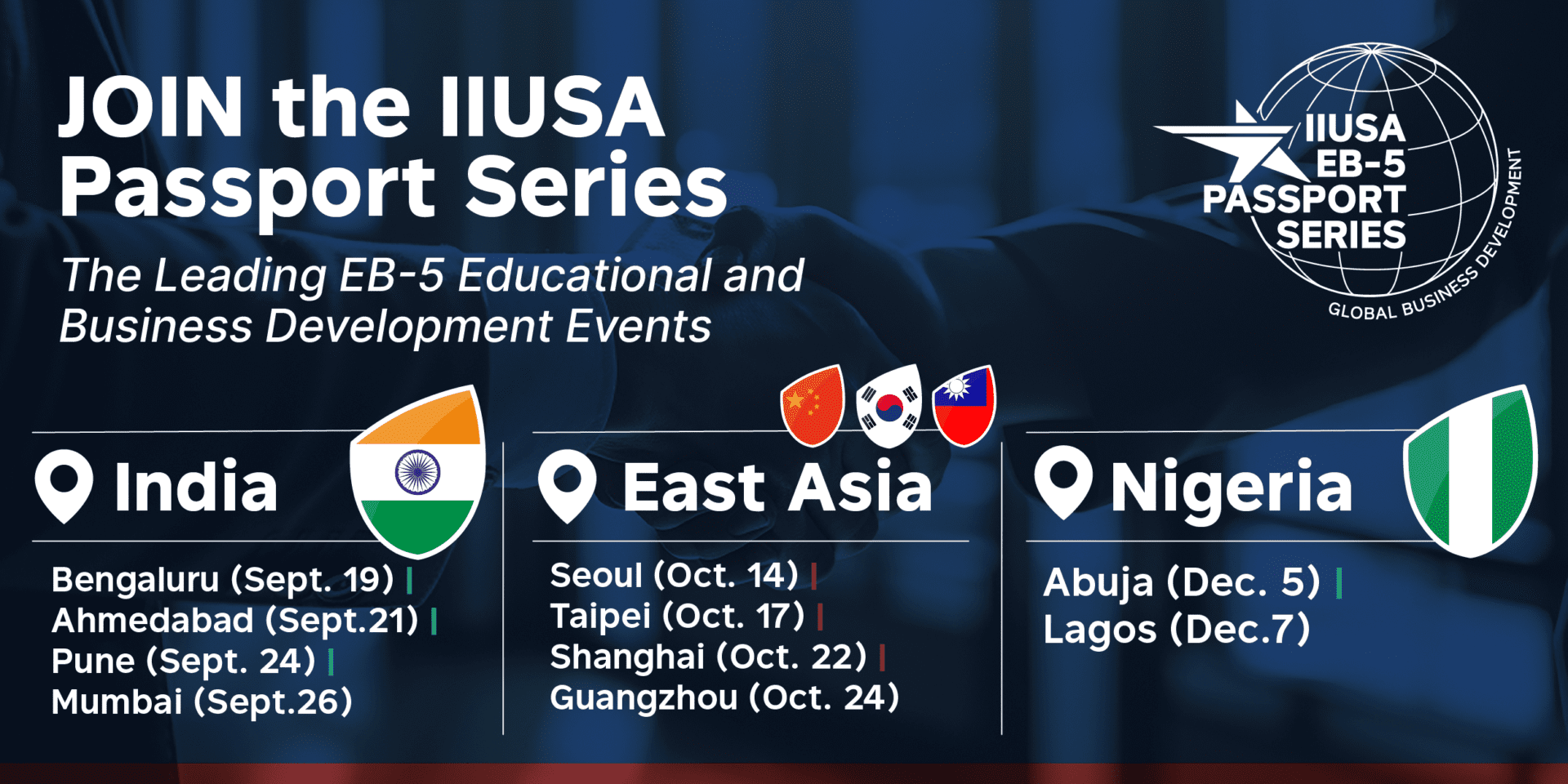

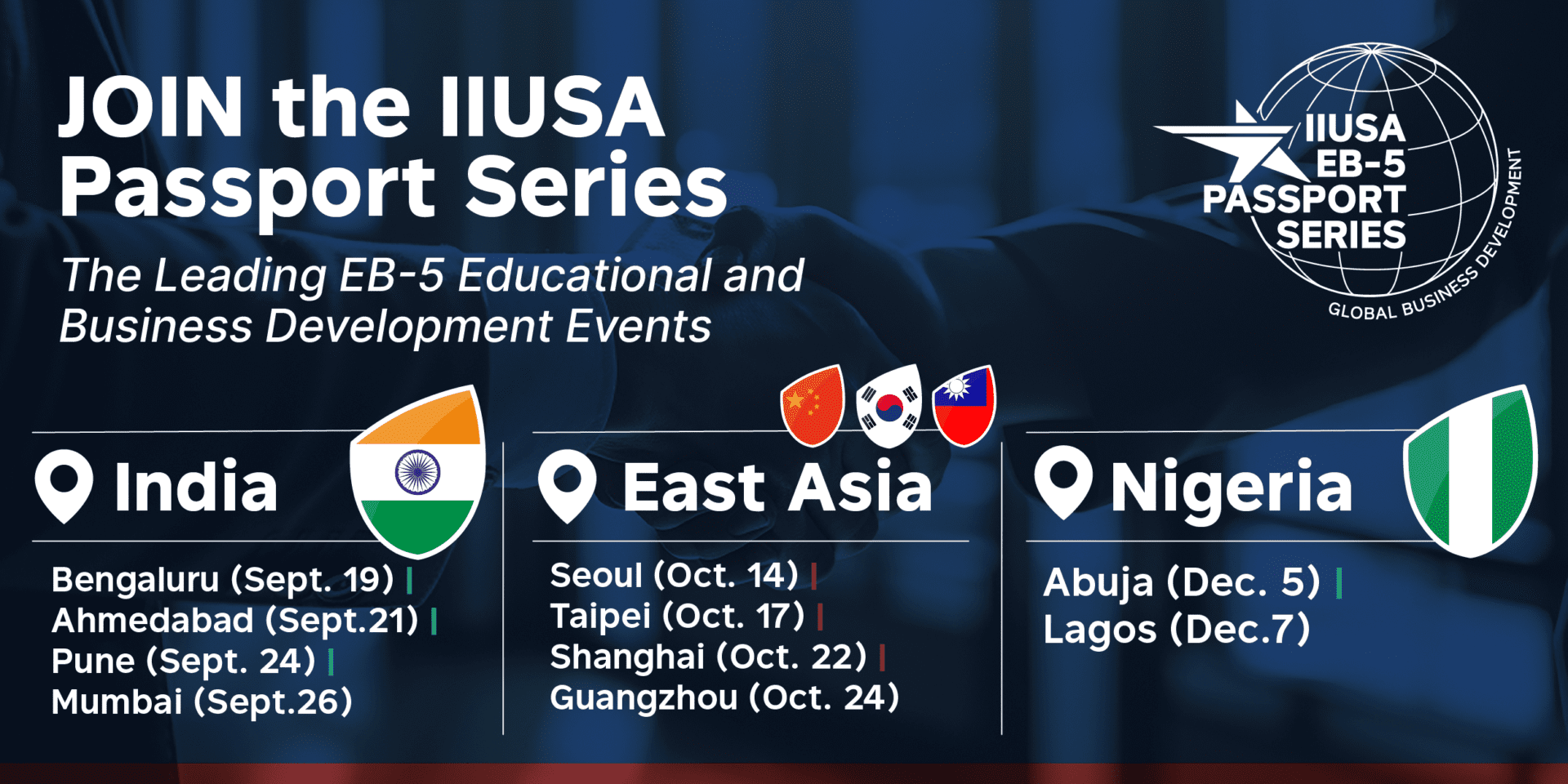

The IIUSA EB-5 Event Passport Series has proven itself to be the leading educational and business development ...

04.04.24

(Click here to read and download the full report in PDF format)

Based on the latest monthly data that the ...

04.03.24

IIUSA EB-5 Passport Series: A Southeast Asia Success Story

As the EB-5 industry continues to thrive globally, ...

04.03.24

Invest in the USA continues to lead in the way in advocating for the EB-5 industry. Recently, IIUSA secured ...